Today, we're talking about the rise and fall of film technology and how one company, Fujifilm, managed to pivot and adapt to new businesses.

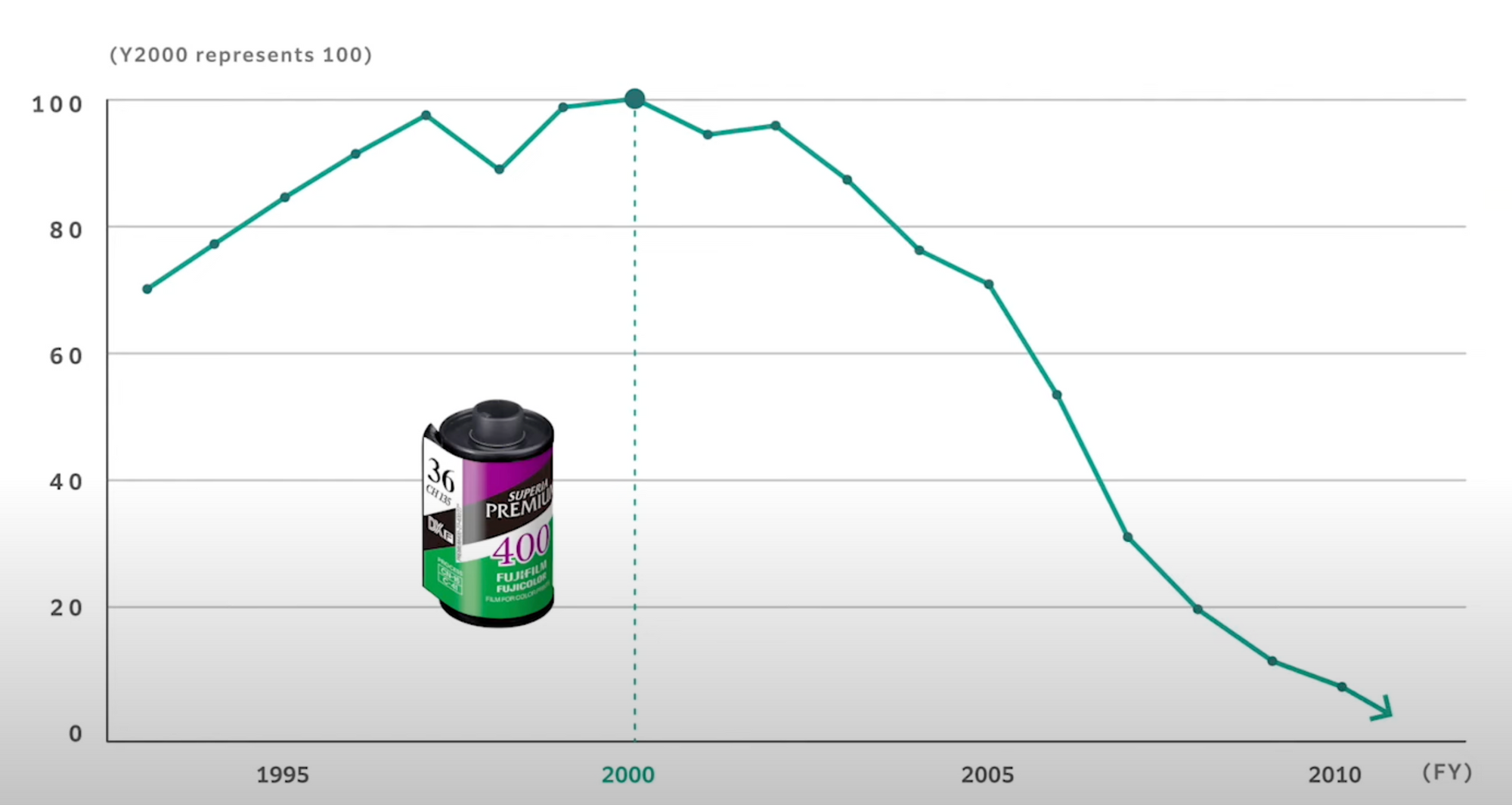

Fujifilm was established in 1934 as a subsidiary of Daicel with the aim of producing photographic films. For decades, Fujifilm dominated the camera film market in Japan, similar to Eastman Kodak in the US. However, the new millennium saw the rapid spread of digital technology, causing a plunge in demand for photographic films.

While both film manufacturers recognized the fundamental change, Fujifilm adapted to this shift much more successfully than Kodak, which eventually filed for bankruptcy in 2012.

But that's just the PR part of the story.

Even in the 1980s, Fujifilm had already prepared to switch from film to digital by developing a three-pronged strategy: squeezing as much money out of the film business as possible, preparing for the switch to digital, and developing new business lines. And it worked!

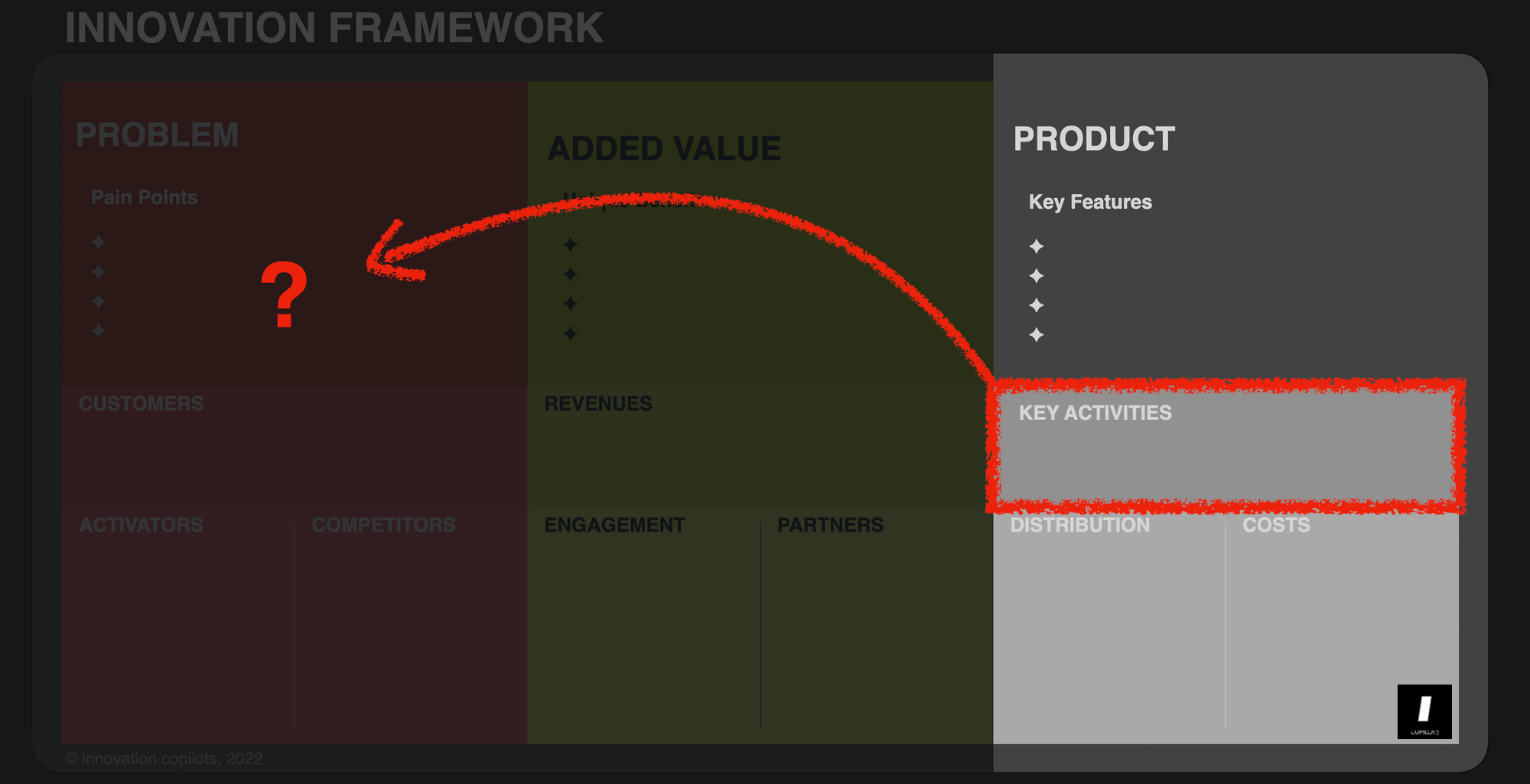

The real story is how the company regrouped around its key assets and activities and rethought the way to push them to the market differently, and later on, expanded its core "superpowers".

This logic is pure business model innovation for a company that understands one thing very well: that they are process-driven.

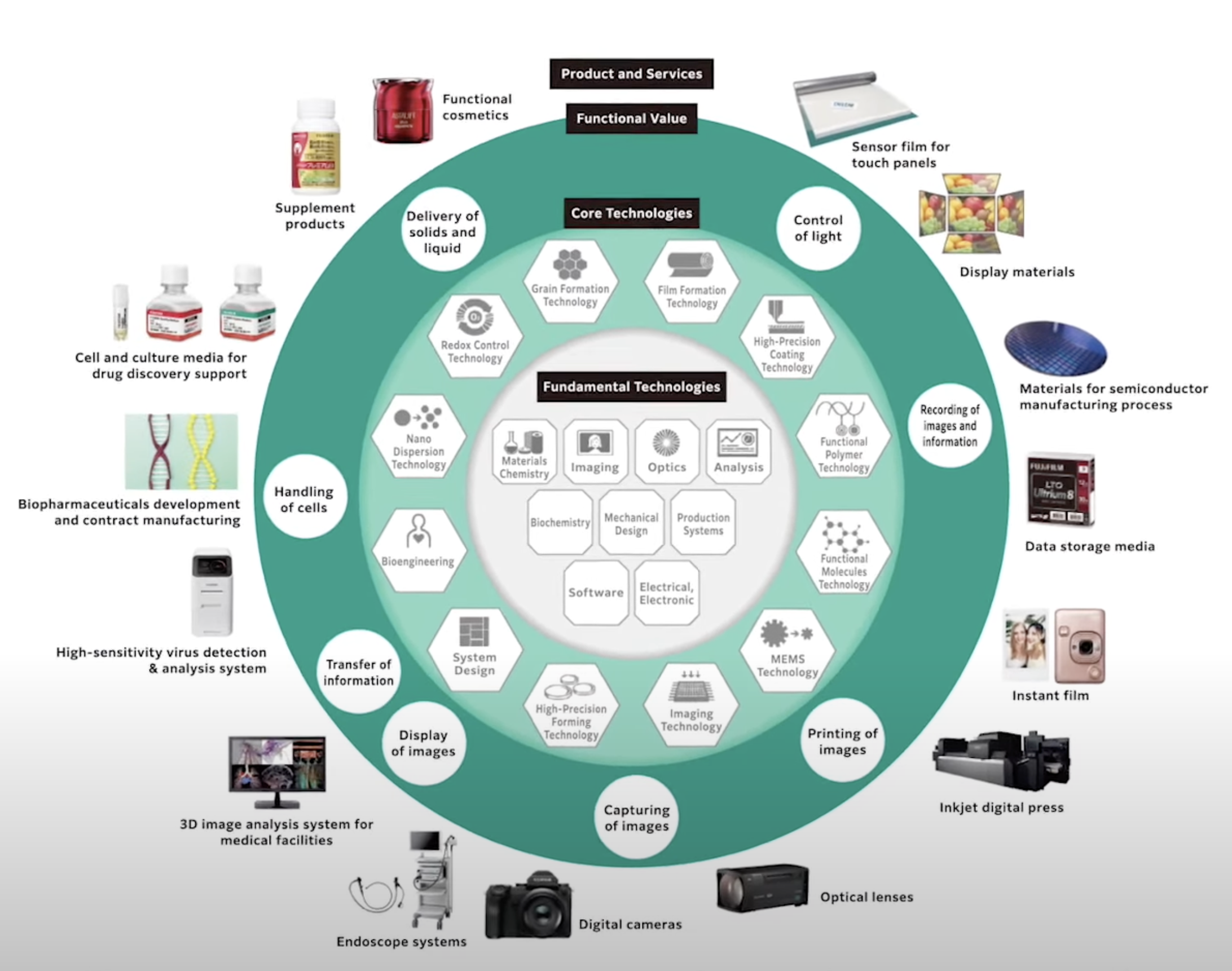

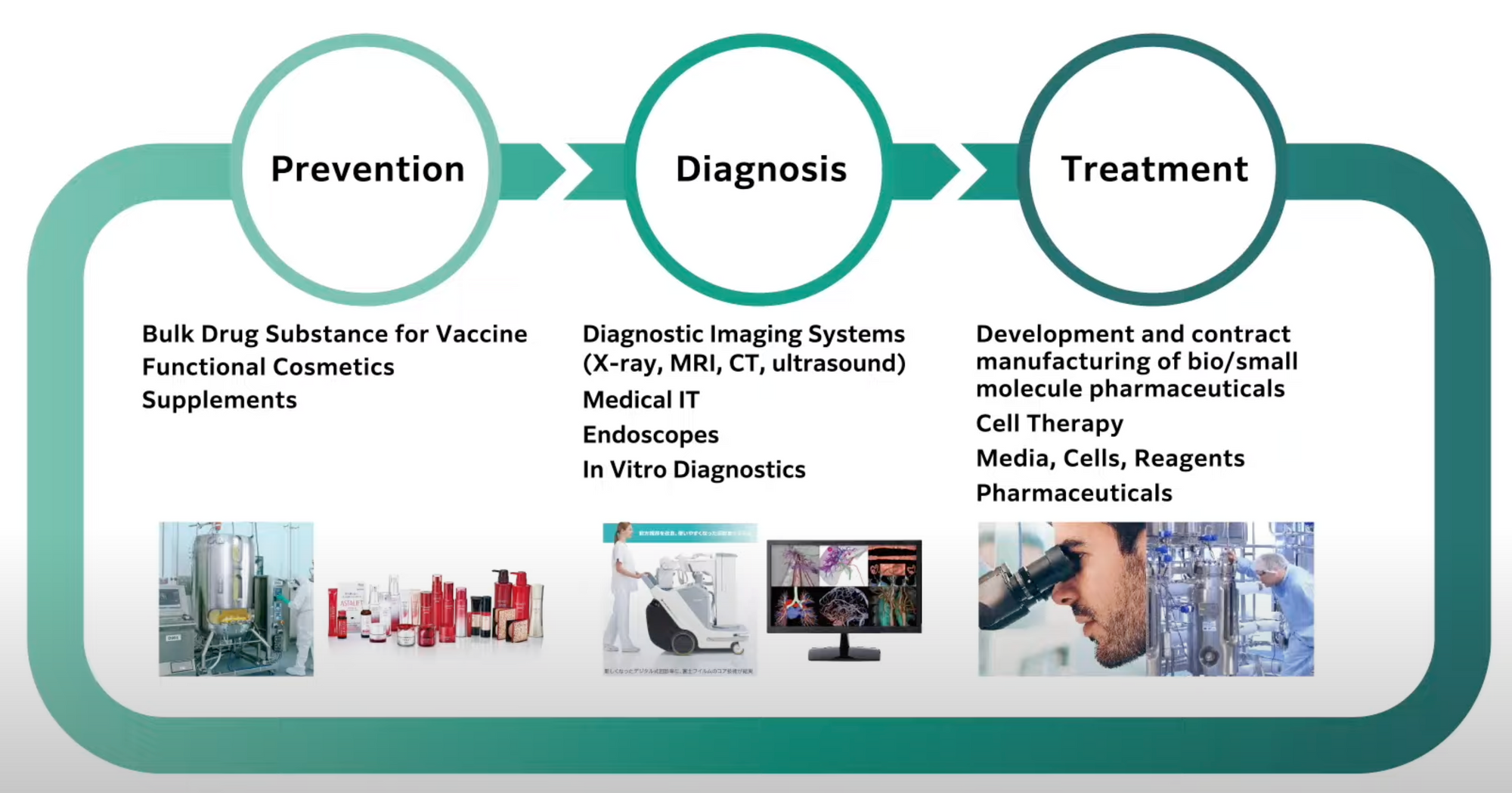

From there, Fujifilm diversified further, penetrating the medical, printing, electronic imaging, and magnetic materials fields. The company invented computed radiography, which solved a number of issues of traditional radiography, resulting in a decrease of radiation exposure to both technician and patient.

In recent years, Fujifilm has continued to invest in new ventures. In 2019, it acquired Hitachi's diagnostic imaging business for $1.63 billion. Amid the 2020 COVID-19 pandemic, one of Fujifilm Toyama Chemical's drugs, named Avigan, is being considered as a possible treatment for the virus.

And this is another remarkable thing. When they found a market where they could expand their activities in a very vertical way, they went full in.

And, of course, the focus on healthcare as a major for them (currently +30% of their revenue streams and aiming for 50% within three years) is not entirely a cold strategic decision.

It's also a cultural element...

For us, the path to healthcare actually began very early on. Two years after its founding, in 1936, Fujifilm made film for X-ray machines in hospitals and in the early 80s, we launched the world's first digital X-ray in Japan before moving into digital radiography, endoscopy and healthcare IT. - Teiichi Goto, CEO

Why do I write about this?

Despite a trove of business school papers on strategic pivots, these success stories are quite rare. I could probably think of Zodiac Aeronautics as one of the other rare cases, but I'd be hard-pressed to think about a dozen more since the eighties, which means that you should read this as a cautionary tale. The odds of your company managing to pull a pivot out of a major technological disruption are slim. It's always possible, and the template to get there is well-known but the practical pathway is vastly uncertain.

Why a few companies manage to pull it off, though? Rebooting not only in s strategic way (which is key) but also around their cultural root: knowing how the work (process-driven in this case) and where are the organizational roots (medical).

If you don't factor in the cultural element, no visionary strategic insight will save you.