I discussed Uberization at length in a recent article. But this is just a model of disruption, among many others. To be complete, I should at least also speak about Teslaization, which I believe to be more dangerous for many companies and their relation to by-the-book disruption. These three states of disruption will shape your company’s future, whether you’re a disruptor or a disrupted.

This quick and dirty roadmap to disruption is not intended to give a full-fledged mapping of all disruption categories. Uberization and Teslaization are interesting in how they polarize the disruptors' risks. It’s about a low-tech / higher market risk or the opposite. Eventually, my goal here is only to share with you how to analyze risks, both as a threat and as an opportunity.

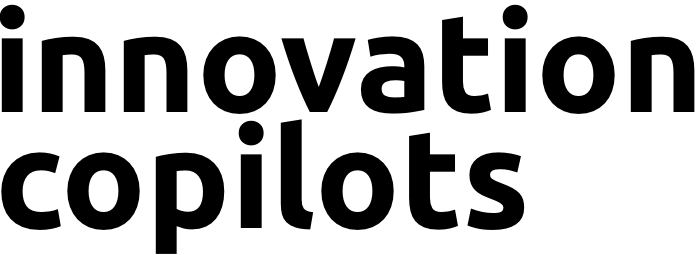

Uberization

How it develops: Powerful companies invest all their resources, maintain a form of monopoly, and extract revenues of position from a market; this market rapidly gets mistreated and hurt. This usually involves a particular form of proprietary asset (or plain laws in some cases) used to lock customers in. In such a case, nimble and aggressive ventures have an easy time swooping in, leveraging generic platform technologies, such as mobile, geolocalization, digital payment, Google, Amazon, or Facebook… to take on the incumbent and beat him on his key added value.

Cases of Uberization: AirBnB vs. hotel resorts, Blablacar and Capitain Train vs. SNCF, Uber vs. Taxi companies, etc.

What is the profile of the disrupted companies: The ones that abuse of position revenues and that are vocally hated by their customers.

How to treat: Renounce some of your privileges, and refocus on adding added value for your customers. How to make a hotel experience switch from bearable to pure joy? How would a retail bank provide essential differentiated counseling to families?

Chance of survival: Honestly? Pretty none. Every fiber of your culture will scream against it and help you build delusions to cope with customers' hate (such as “They don’t realize how good they have it, if we weren’t there, it would be much worse”).

How risky is it:

It is quite “safe” to go and try Uberize an incumbent. To rephrase what I already said:

- His customers hate him and are ready to switch in a blink of an eye;

- He got bad at delivering his own added value;

- Generic platform technologies can be 80% of your back-office if you manage to focus on user experience and bring back delight to the market.

This is why “Uberization” currently gets so much press coverage. It feels like everyone and her grandmother could be the next Uber. And that’s the case, to some extent.

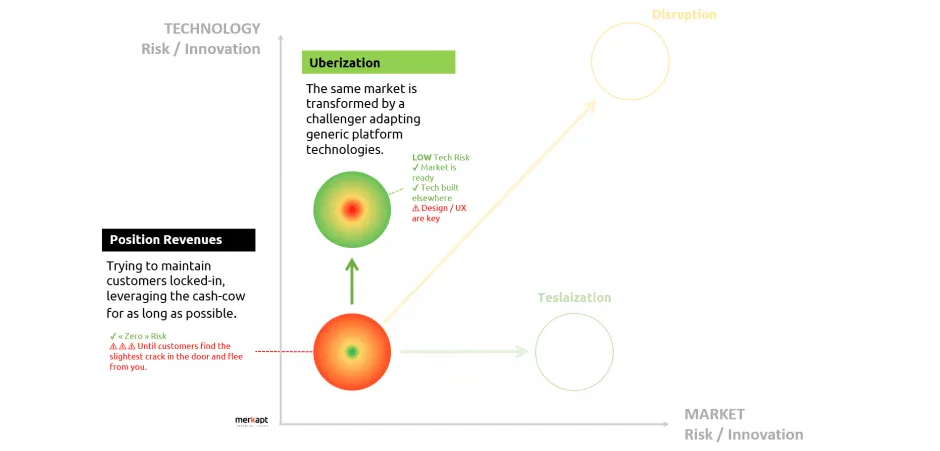

Teslaization

How it develops: Any company leveraging a technological asset may face a tremendously powerful competitor surging from an entirely different market. This competitor will have much better technology, initially built for an entirely different purpose. It just happens that it’s a cost-effective pivot of their core business.

Cases of Teslaization: Well, Tesla comes from the electric car business, challenging SNECMA with Space X. But also Tesla challenging energy providers with Powerwall and public transportation companies with Hyperloop. Before that, Amazon developed the most powerful B2B cloud services out of their e-commerce backbone.

What is the profile of the disrupted companies: None specifically. Unlike Uberization you haven’t slipped or done wrong on your market. It just happens that someone was building technology for its purpose, which also has killer features in your market. And they are being smart about it.

How to treat: Take this threat seriously. You may feel they are uneducated on your market and that they aren’t just going to walk in. You probably overestimate the barrier to entry market-wise. And they have better technology, remember? Now, you can take preventive actions, such as exploring for yourself adjacent markets with your core technology. Or, at least invest in startups pushing your technology in new directions. You’ll immediately meet your most powerful potential competitors. The trick is that you have to do that well before any serious threat starts to appear. This is tremendously difficult.

Chance of survival: Excellent if you can foresee the troubles coming from markets that have no connections to yours. Because then, it’s mainly a resource game about technology. And we know how to improve technology. But this is what is usually impossible: it’s difficult for your board to accept that form of danger as a solid possibility; your stock market just won’t get it; and consulting companies that assist you essentially think that your competitors are the ones that are developing the same offer as you are, not invaders from another planet.

How risky is it:

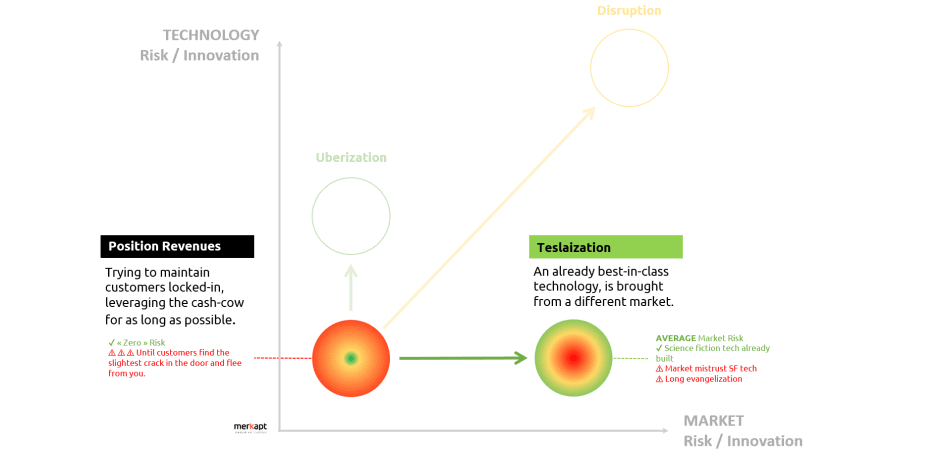

Disruption

This last one is the “by-the-book” definition of disruption, coined by Clayton Christensen in 1995.

It is, to some extent, the conjunction of Uberization and Teslization: a new market is formed by a competitor bringing new technology to your market, leaving you out of customers with outdated solutions. In theory, Wikipedia would have destroyed and replaced modern education. We could argue that yes, sadly… But business schools, for that matter, are still striving. As far as I’m concerned, I have no example of “disruption.” Disrupting an incumbent happens whether on the market side or the technology side of the market. Essentially, the disruption would be overkill, and neither really happens. Except in business textbooks that unspecifically keep this word to cover the generic idea of “bad things can and will happen eventually to your business.” On their side, media have long traded the generic disruption word for Uberization, which doesn’t mean anything precise either.

The overall picture, in terms of risk assessment, would be something like that:

Risk is key

Eventually, you should make peace with risk as a positive asset for your business.

This way of understanding innovation about the quality and the intensity of risks taken is vital for startups. “What kind of risk are you leveraging?” is a top priority in evaluating a startup project. Not many startupers can understand – even less answer – the question. But there you are with a template answer:

- You are actually aiming for ambitious disruption by reinventing technology and changing the way the market will use it, it’s probably too high a risk. But at least particular investors can connect with you if your team is a group of seasoned entrepreneurs with tremendous tech/design/business skills.

- You play safe and stay in a safe zone, not pushing the market away from where it is, not bringing technology to the table… Well, this is TOO safe. You’re fighting with incumbents companies doing the very same thing, more or less in the same way. You just don’t have credentials and enough resources. This is crazy. Stop and take MORE risks.

- Or you have a “thermodynamically” efficient level of risk – may it be about Uberization or Teslaization – that can bring a powerful change to the market (we call that innovation).

The key point of all this is that in the end, whether you are a fully developed industrial business or the flicker of a startup idea, not taking enough risk is too much of a risk.